Background

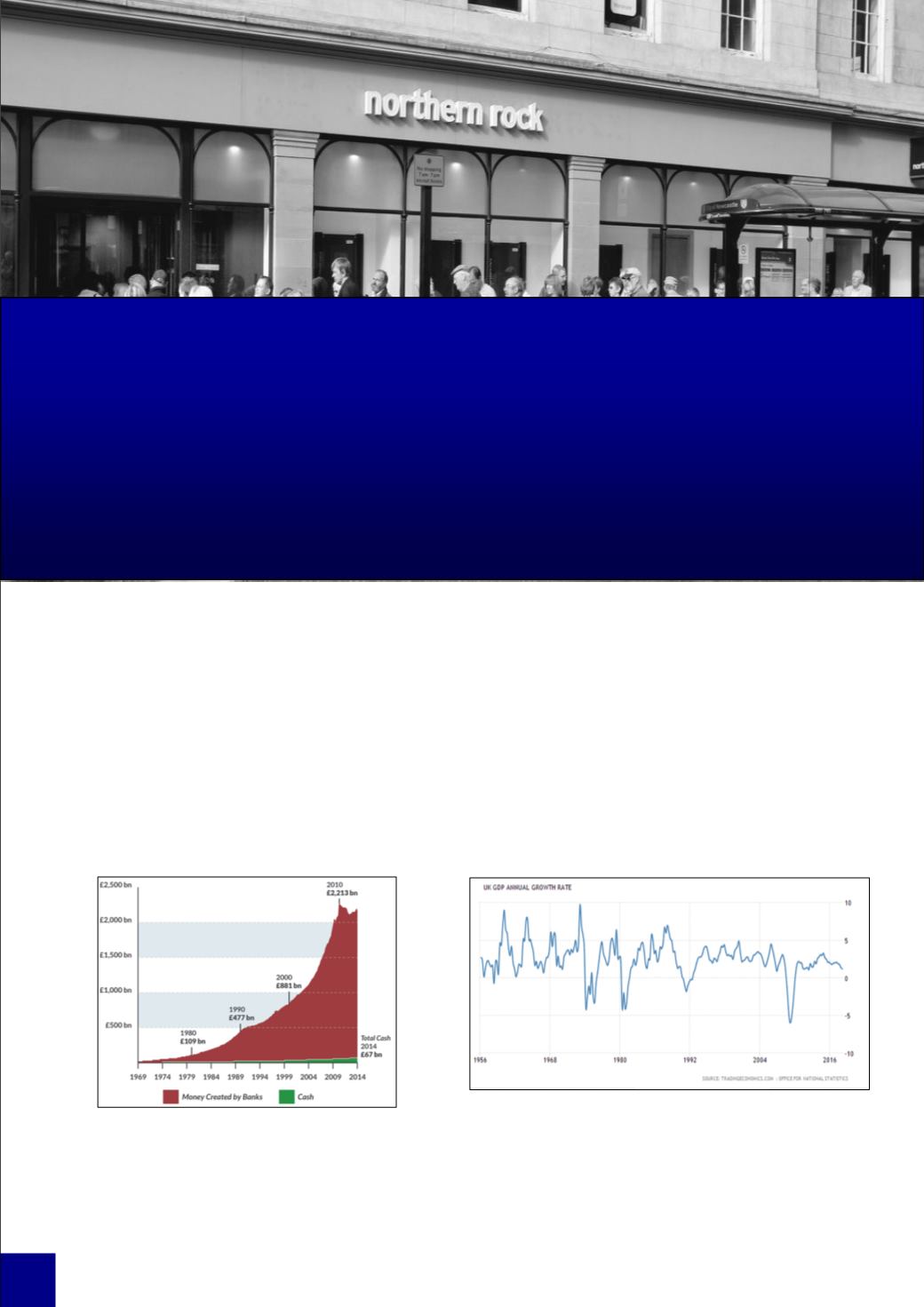

In the late 20th and early 21st century over a period of 7 years,

UK banks doubled the amount of lending in the economy creat-

ing huge amounts of credit in the form of loans causing house

prices to rise. This fuelled an increase in demand-pull inflation

of just over 5%. Eventually these debts were unpayable by the

people who took out large mortgage loans which led to the fi-

nancial crisis. The financial crisis led to a 26.2% decrease in

house prices in just under two years.

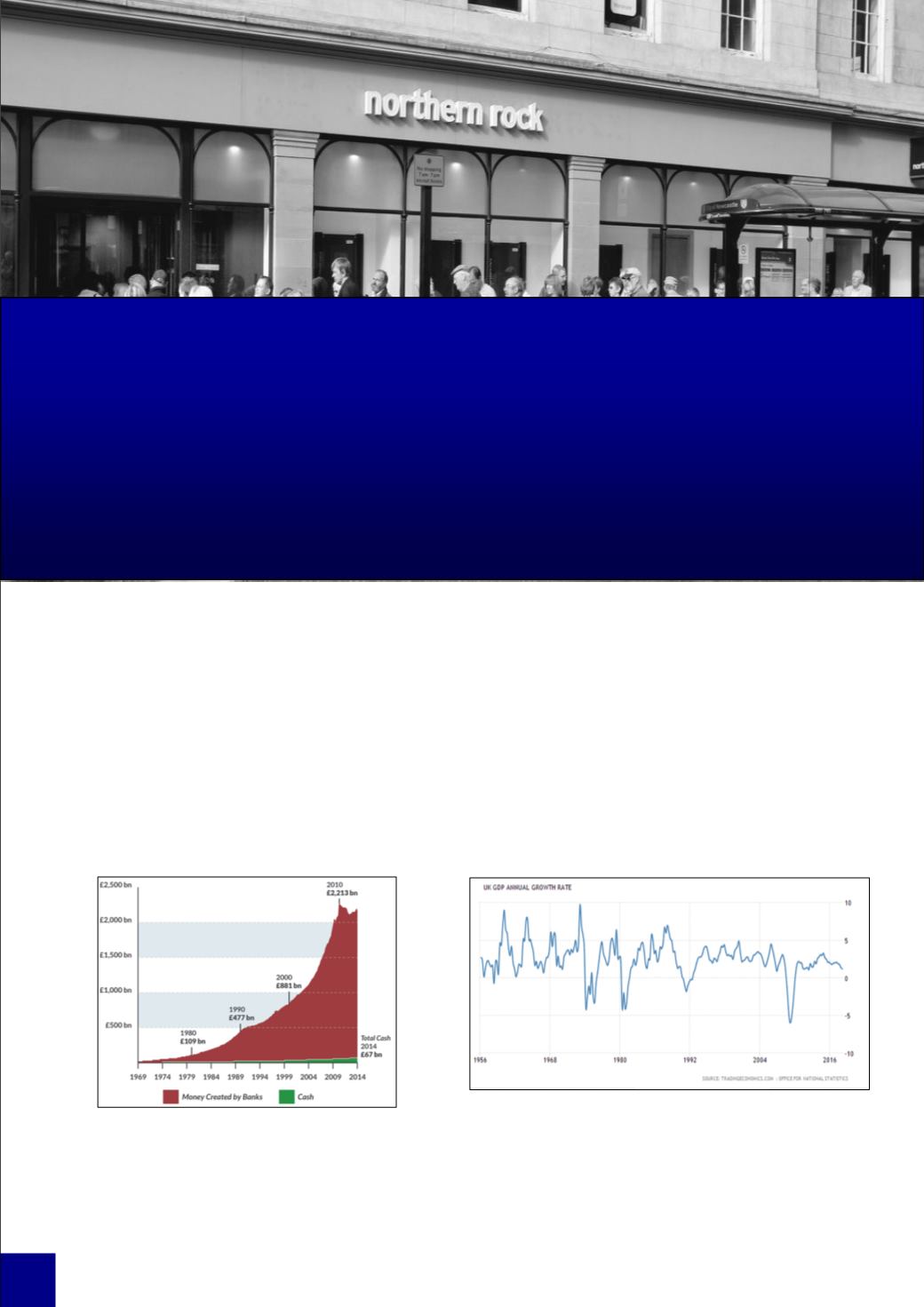

UK GDP fell by 1.5% in the last three months of 2008. Following

the recession, bank confidence has hit an all-time low as banks

refused to lend money which contributed in causing the econo-

my to shrink. It became harder for businesses to expand as ap-

plying for loans became much harder.

United Kingdom economic growth averaged 2.4% from 1956

until 2018, but reached a record low of -5.9% in the first quar-

ter of 2009. Government statistics carried out by the TUC re-

veals that the current speed of recovery is considerably slower

than the economic bounce back that followed the UK’s previous

eight worst recessions dating back to 1830. The Office for Na-

tional Statistics showed that the economy grew by 0.7% in the

last quarter of 2015.

In the five years since the global recession began in 2009, the

UK’s total rate of growth has been just 6.1%. Set against the five

year periods that followed each of the eight worst recessions in

Britain since 1830, this is the slowest recovery on record. The

rate at which GDP rose after the recessions of the 1970s and

1980s was 11.4% and 15.5% respectively. Recovery from the

Causes and Impacts of the

2008/2009 Recession

Kareem Eissa

12