Just last month the Bank of England chose to raise interest rates

from 0.5% to 0.75%. One month on we can now begin to see

the impact of these on our economy, but why were they raised?

The Bank of England’s recent decision to raise the Bank Rate to

0.75% has set out to keep the rising cost of living under control,

while a gradually strengthening economy post the EU referen-

dum coupled with the lowest unemployment levels in 43 years

have also played a part in the decision by the MPC to raise the

Bank Rate. While this is good for the UK’s 45 million savers,

across the UK 9.1 million households have a mortgage, with 3.5

million of these variable rate.

The impact on those with variable rate mortgages is evident,

with price increases across the board, however for those who

wish to save, no easy access savings account at a High Street

bank pays an interest rate greater than 0.5%. This is evident in

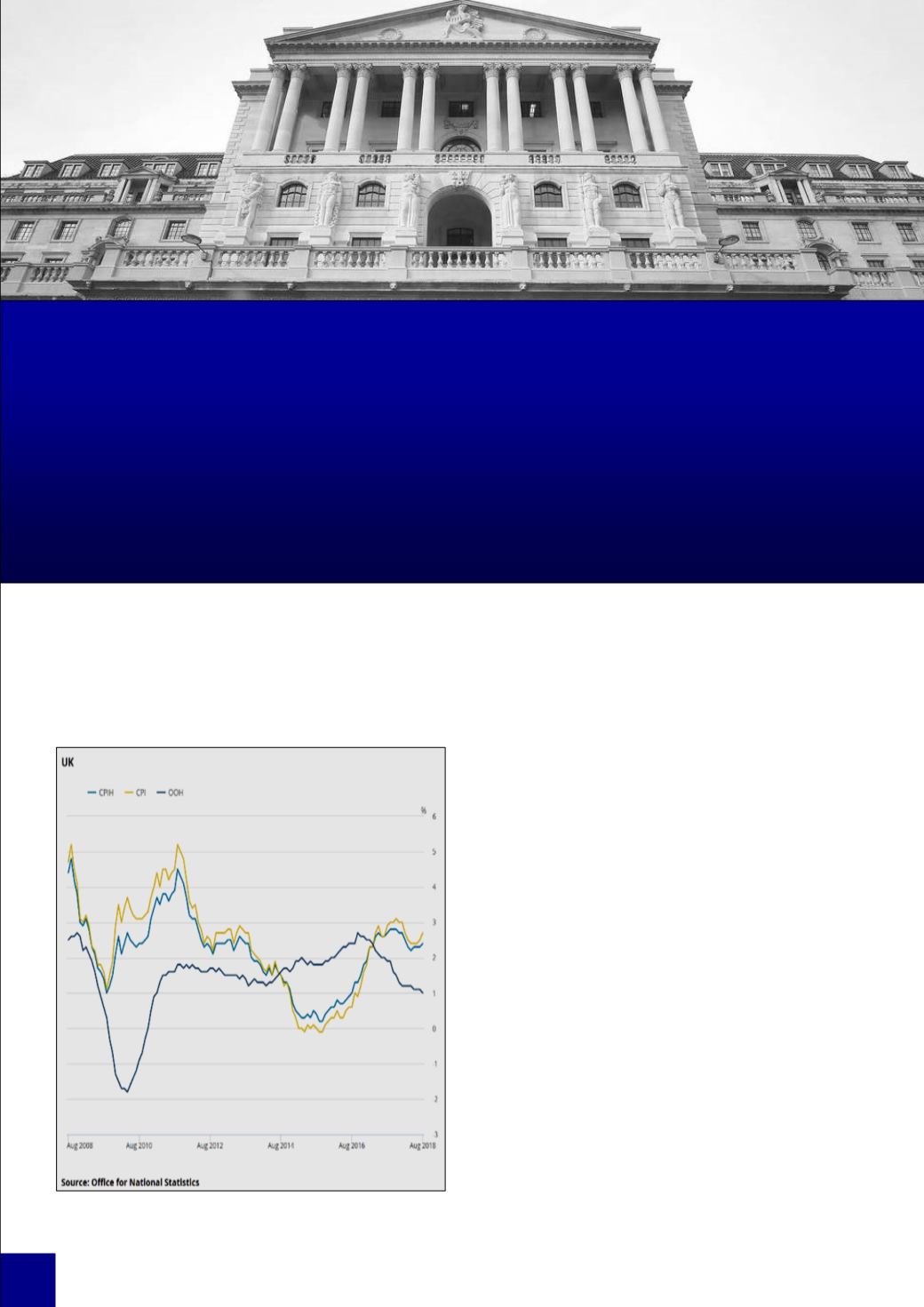

the Office for National Statistics most recent report on the CPI,

with the Consumer Prices’ Index including owner occupying

housing costs (CPIH) rising from 2.3% to 2.4% following the

appreciation of the Bank Rate.

The key aim of the interest rate rise imposed by the Bank of

England was to lower the rate of inflation towards the target

2.0%, with forecasters predicting that, following the rise in Au-

gust, the rate of inflation would fall from 2.5% to 2.4%, edging

towards the target set, however, unexpectedly, it was seen in

August that the rate of inflation rose to 2.7% following a rise in

July also, but why is this the case?

Rate increases, despite leading to cuts in both spending and in-

vestment, are inflationary due to the increase seen in the cost of

August’s Interest Rate Rise:

Has it Achieved its Purpose?

Sam Yellops

Article written October, 2018

20