case for moving them to DB’s home city, Frankfurt. The British

government has been moderately silent about the deal. Some

politicians nevertheless express worry that the merged compa-

ny’s headquarters might relocate to Germany, taking euro-

denominated clearing with them. On July 3rd Sumitomo Mitsui

Financial Group Inc. (SMFG), Japan's second main lender by

market value, broadcasted that it would establish its European

banking subsidiary in Frankfurt. The move will avoid any dis-

turbance to its services should the UK lose access to the EU's

single market. SMFG will additionally incorporate its European

securities subsidiary, SMBC Nikko Capital Markets, in Frankfurt.

The banking group shadows its national competitors Nomura

Holdings Inc. and Daiwa Securities Group Inc. in shifting its

European base to Frankfurt. Frankfurt Main Finance (FMF), an

industry-lobbying group for the German city, confirmed that

SMFG would launch two subsidiaries in the city. Last week, the

FMF said that around 20 global banks were considering the de-

velopment of operations or establishment of subsidiaries in

Frankfurt.

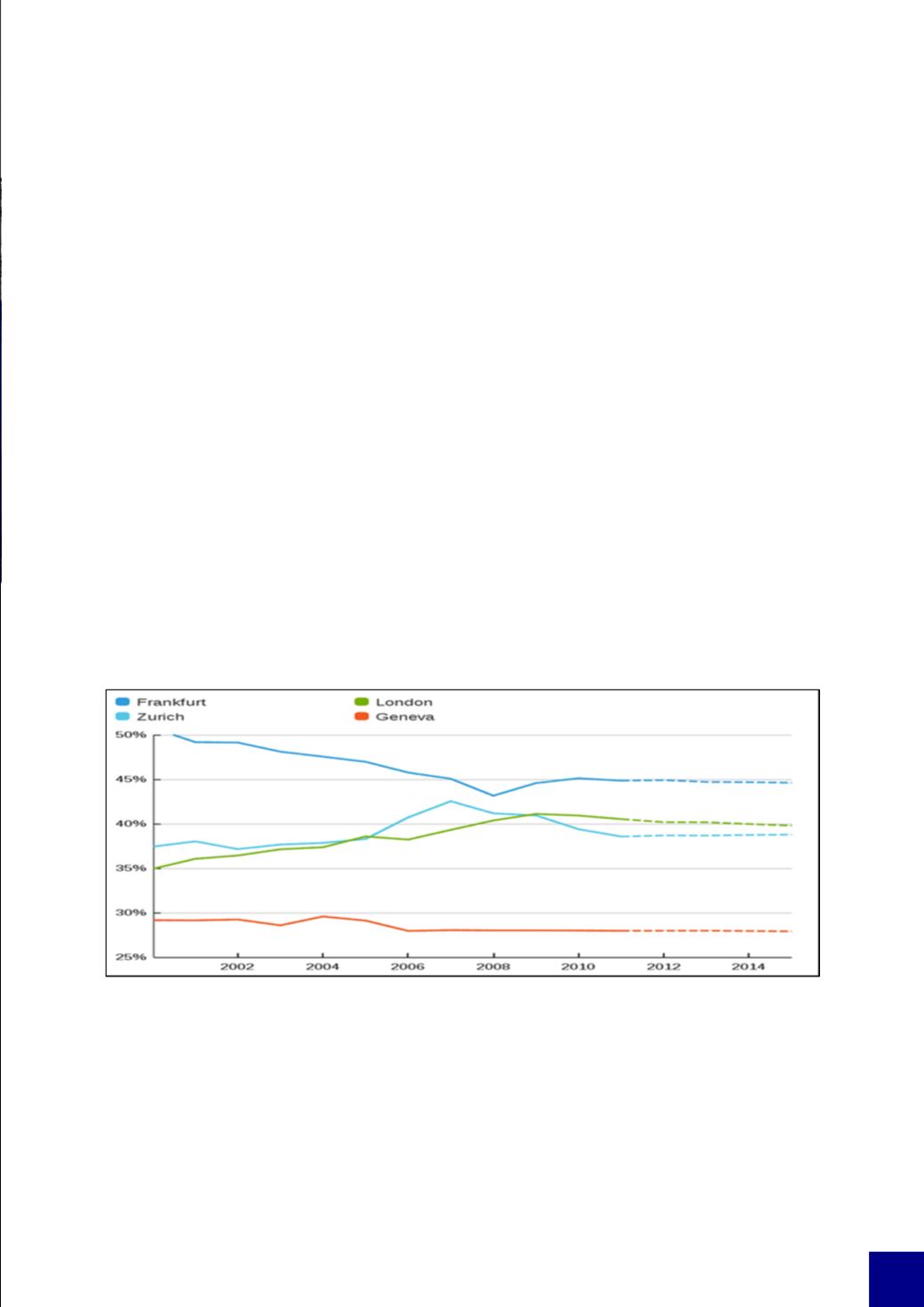

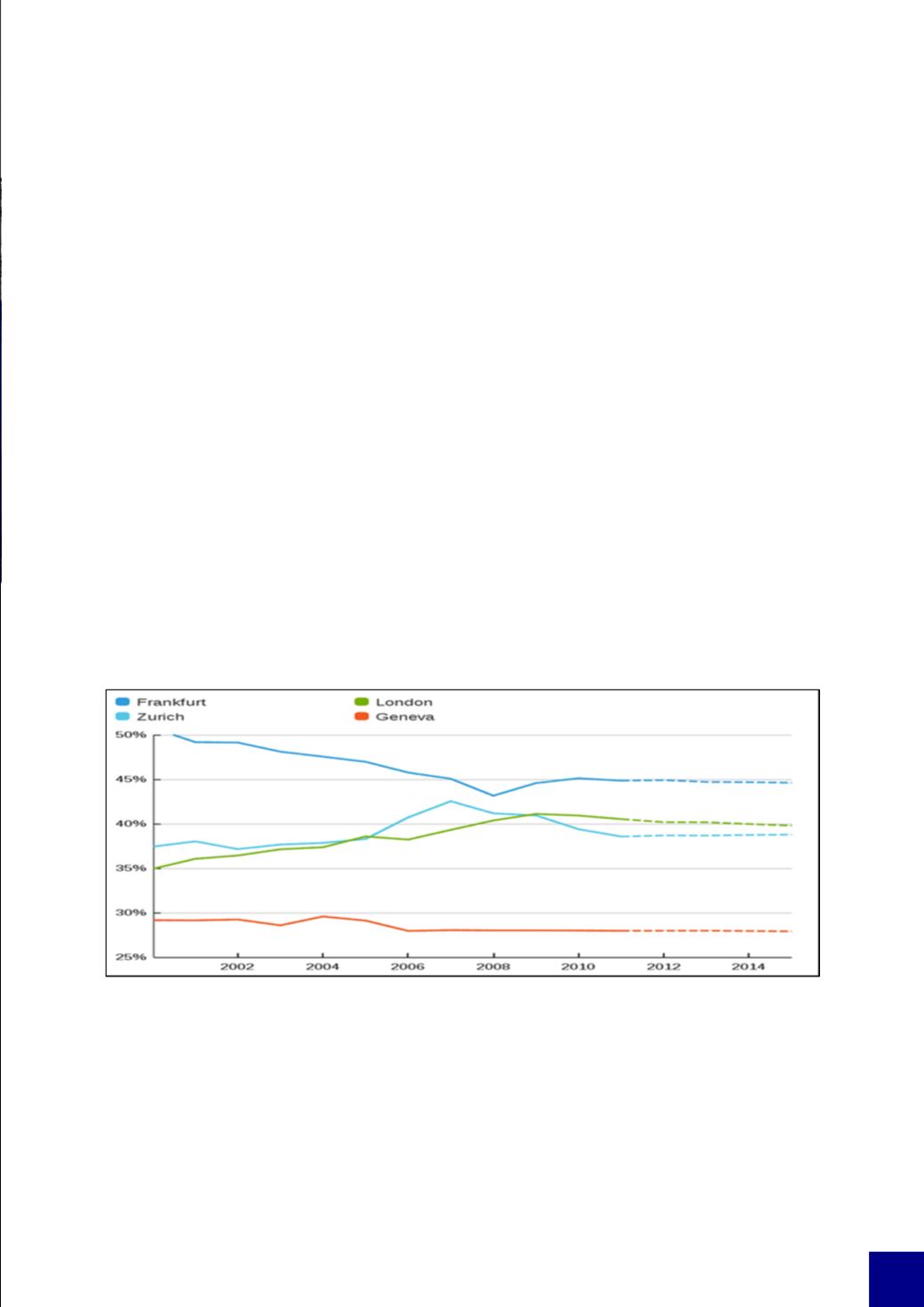

As the graph shows, London is no longer the main city in Eu-

rope that relies on the financial sector as the highest proportion

of its GDP, with Frankfurt being higher from before 2002. This

provides further reason for Frankfurt to be the new financial

sector of Europe after Brexit.

However, as the graph’s general trend is that the proportion is

rising in London since 2002, whilst it is falling in Frankfurt.

This may be due to the popularity of London being the world’s

financial Capital. Although, this percentage has been falling

since 2011 in London, suggesting that in the UK the financial

sector is becoming less popular recently. This is likely to fall

even further due to Brexit being on the horizon.

To conclude, the UK is very likely to suffer due to leaving the

EU, and if there is a no-trade deal with the European countries

by March 2019, it is very likely that the world’s centre for fi-

nance may move from London to another city, most notably

Frankfurt.

5

Percentage of income from the Financial Sector for various European Cities